The Latest from TechCrunch |  |

- “Will It End Very Badly?” Probably Not.

- Curisma Offers DIY Coolhunting

- (Founder Stories) Bump’s David Lieb: “Stop Thinking & Just Go Build It”

- Akamai Reportedly Buying Rival Cotendo For Up To $350 Million

- Josh Kopelman: “I Think 2012 Will Look More Like 2008 Than 2011″

- Review: Super Mario 3D Land For The 3DS

- How to Make Your Startup Go Viral The Pinterest Way

- (Founder Stories) Bump’s David Lieb: “We Want To Build That New UI Layer For The Real World”

- Cyber Monday Piggybacks On Social Media To Become Top Online Shopping Day

- Thanksgiving + Black Friday Mobile Traffic Up 60% From 2010

- Sing Now The Praises Of Klout’s Klumsy Kludges

| “Will It End Very Badly?” Probably Not. Posted: 27 Nov 2011 09:34 AM PST  Editor's Note: Guest contributor and early TechCrunch writer Steve Poland (@popo) currently is exploring raising a fund to join the “overcrowded” early stage investment market. His last contribution was The New Early-Adopter Addiction: Turntable. Last week at David Kirkpatrick’s Techonomy conference, Sean Parker said “Little startups are ridiculously overfunded. The market is ridiculously overcrowded with early stage investors. This results in a talent drain, where the best talent gets diffused and work for their own startups." VC Jim Breyer added, “And it will end very badly.” Here's what that might sound like to many veteran ears: "Ahh! Blubble!" Times have changed. The web and mobile startup ecosystem of Silicon Valley has fully matured. Anyone can be an entrepreneur, and almost anyone can be an investor in startups. It previously required millions of dollars to fund a tech startup, and so they were mostly (now) big names in semi-established fields–Netscape, Google, Amazon, and PayPal, for starters. But this also sparked the Internet revolution. People interested in carving out their piece of this Internet revolution didn’t have many options, and so the talent pool centered around those big, multi-faceted names. Venture captialists holding hundreds of millions of dollars held the sole responsibility of selecting those entrepreneurs that would lead the Internet revolution, since millions of dollars were needed for the most basic web infrastructure and to build an idea and achieve a product/market fit. Exits on these companies resulted in newly minted “tech” millionaires. As the infrastructure of the Internet revolution was built out, the capital needs of smart new web companies reached toward zero. With capital needs lowered, but VCs still focused on large-scale investments and the resulting returns, angel investors (wealthy techies) started placing small bets, from their own wealth, on entrepreneurs. VCs lost their super status as super angels (like Dave McClure and Jeff Clavier), early-stage funds (including First Round Capital), and startup accelerators (such as TechStars and Y Combinator) gave entrepreneurs more access to smaller-scale capital, and more direct mentoring and personal investment. More startups got funded and found profitable exit strategies of their own, resulting in more millionaires, and then another bump in the number of angels. Over time, that means that capital is no longer the primary competitive advantage for an investor. There are many, many more angel investors in the tech industry, writing checks to entrepreneurs they (hopefully) believe in. To Sean and Jim’s point, more people are starting their own startups instead of joining others, which is spreading out the talent pool in Silicon Valley and this flood of fresh capital is resulting in investor competition to invest in startups, resulting in higher valuations and speedier funding cycles. Early stage "Series A" valuations have surpassed the $4 million line and are now averaging in the $6 million – $8 million range. A lot has changed over just a few years and the market has simply corrected valuations, increasing the averages. As long as these increased valuations sustain themselves through exit, then everything still works for investors. The scary part for veteran investors is that they know there still remains a limited pool of buyers to achieve an exit — and building sustainable independent private companies doesn't work for a VC's business model. A VC fund's limited partner investors are expecting a 10-year investment with a cash return, not ongoing future cash dividends. The industry needs more private market liquidity opportunities (secondary markets, private equity firms, etc). So what’s next in this cycle for Silicon Valley? We'll continue to see entrepreneurs and investors in Silicon Valley venturing into uncharted waters, where revenue models are an after-thought. The wide access to capital for entrepreneurs isn't going away anytime soon, especially with a slew of tech IPOs on the horizon, which will create even more Gentlemen VCs. Venture capitalists that invest full-time will begin further diversification of their funds outside of Silicon Valley and into other startup ecosystems, where capital for web and software-based startups isn't as readily available. Today it is easier and faster for entrepreneurs to build products and create value than it was just a few years ago. Monetization platforms (advertising technologies, mobile platforms, virtual currencies, etc) are in place that allow startups to generate revenue. The entire ecosystem (mentors, talent, technology, capital) supporting entrepreneurs and startups has matured. All of these factors have reduced investor risk compared to a few years ago. Even if that risk is lessened by only a few percentage points, this has created a funding model of higher valuations that can still work for the growing ranks of angel investors. This isn't stupid money flying around in the Valley. These new Angel investors are the product of 15 years of industry experience, and many cycles, some of them quite harsh. These new investors are bringing a wealth of experience, success, failure lessons, and connections. If they are committed to mentoring these new startups into building real businesses (and not gambling in hopes of picking the next startup homerun), then this class of internet revolutionaries will be well groomed to build the next generation of job-creating brand names. Here’s to the crazy ones. [Image: wavebreakmedia/Shutterstock] |

| Curisma Offers DIY Coolhunting Posted: 27 Nov 2011 09:29 AM PST Like putting a donk on it, it seems like every new website needs to have a daily deal. Take Curisma, for example. On the surface it’s sort of an Oink-like website dedicated to the curation of cool products. Underneath, like a the cowbell in Don’t Fear The Reaper, is a daily deals site. Luckily, the curation of Curisma is far more interesting than the daily deal, which just might save this start-up. Founded by MIT students Fatma Yalcin and Eugene Gorelik, the site allows you to post stuff with a link to said stuff. Like watches? Post up a watch. Like a fancy lamp? Put that sucker up there. Presumably, over time, the database will burst at the seams, creating a Katamari-like wunderkammer. Right now it’s kind of barren. The money is to come from sales through the site – hence the daily deals – and through affiliate sales with associated objects thereby curated. There is also a rating system for folks to rise to the top of the curating ladder. Does the world need another Oink (or Blippy, for that matter?)? I’m going to withhold my judgement, but the design here is clean and clever and I could see the potential value to folks looking for a clever gift for the man or woman who has everything. |

| (Founder Stories) Bump’s David Lieb: “Stop Thinking & Just Go Build It” Posted: 27 Nov 2011 08:06 AM PST  Bump co-founder, David Lieb launched an app that’s secured roughly $20 million in funding and has been downloaded approximately 60-million times. In his final Founder Stories interview with host Chris Dixon, Lieb predicts the next hot sector, discusses hiring employees and dishes out advice for future founders. When asked by Dixon to name his favorite “mobile apps” Lieb responds he is a big fan of “realtime information” and lists Twitter and Facebook as top picks. He continues by saying that approximately “5 billon” smartphones are expected to be in service within the next few years and believes that, “the next wave of really important companies will be mobile first.” Later in the interview Lieb tells Dixon that hiring talent hasn’t been an issue for his team and admits that while some workers may have gotten away, “It turns out the people you really want to hire, find you.” He wraps by saying that he’s seen too many founders suffer from “analysis paralysis” and urges entrepreneurs to “stop thinking and just go build it.” Recognizing that if his team had overanalyzed Bump, it never would have gotten off the ground. Make sure to watch the entire interview for additional insights, including Lieb’s take on how founders can help separate themselves from the pack. Here are episodes I and II of this interview. Past Founder Stories shows featuring Dustin Moskovitz, Eric Ries and many other leaders are here. |

| Akamai Reportedly Buying Rival Cotendo For Up To $350 Million Posted: 27 Nov 2011 03:19 AM PST  Classify this as a rumor for now, but Israeli business press is reporting that Akamai is poised to take over one of its competitors, website and mobile acceleration technology vendor Cotendo, for $300 million to $350 million. Founded in 2008, Cotendo has raised over $36 million in funding from investors like Sequoia Capital, Benchmark Capital and Tenaya Capital. A few months ago, Cotendo raised $17 million in new funding from its previous backers, with Citrix Systems and Juniper Networks stepping in as strategic investors as well. Other strategic partners include Google, AT&T and Sumitomo Corporation. The company specializes in acceleration services for dynamic Web apps, static and dynamic web content, performance monitoring and automatic failover as well as real-time reporting and analytics. Obviously, Akamai also provides such services to its clients, but is much bigger than Cotendo. On an interesting sidenote: a year ago, the Massachusetts Institute of Technology joined Akamai in suing Cotendo over patent infringement. Cotendo is headquartered in Silicon Valley with R&D facilities near Netanya, in Israel. Its three co-founders are Commtouch Software veterans. According to Globes, Cotendo customers include Zynga, Vistaprint and Facebook. The company’s advisory board includes Jonathan Heiliger, currently VP of Technical Operations at Facebook. |

| Josh Kopelman: “I Think 2012 Will Look More Like 2008 Than 2011″ Posted: 26 Nov 2011 11:33 PM PST  Remember, R.I.P Good Times, the Sequoia slide deck in 2008 warning its portfolio companies to batten down the hatches and “spend every dollar as if it were your last”? Things aren’t yet quite as dire as the last time the economy tailspinned into recession, but a number of factors are making some startup investors wary. “I think 2012 will look more like 2008 than 2011,” warns First Round Capital’s Josh Kopelman. His pace of investing has not slowed down. He’s just being realistic. Speaking to other early-stage investors recently, I get the same sense that the froth (dare I say “bubble“?) of the past 18 months is coming to an end. Many VCs (and founders) have been feasting, and now it might be time to take a breather. The number of seed-stage fundings is outpacing series A fundings. And whether you consider this a Series A Crunch or not, many more seed stage companies got funded over the past 18 months than previously and many more will subsequently not continue to get funded when it comes time for a series A. Many of the top-tier VC firms who have been scrambling to get into as many seed deals as possible, are now being extra cautious and selective. When a big-name VC declines to invest again a second time around that sends a negative signal to the other potential investors and can often kill a deal. I am starting to hear stories of exactly that happening. At the same time, VCs are fighting each other more fiercely than ever to get into the top deals and will pay whatever the price. Yet, on the larger economic front, things don’t look so rosy. Overall economic growth remains sluggish at (a recently downward-revised) 2 percent last quarter, unemployment remains at a very high 9 percent, and governments around the world (including the U.S.) are in the throes of major debt and deficit crises. Both consumer and enterprise spending on technology is directly tied to the economy. Kopelman is right. It’s not R.I.P Good Times quite yet, but be prepared to see some bloodletting. The easy money might not be so easy anymore and the economy is still limping along. A shakeout isn’t necessarily a bad thing. It means less competition for those who survive and it forces them to find their business model faster. If you look back at companies that were founded in 2008, they include Airbnb, Groupon, and ngmoco.

|

| Review: Super Mario 3D Land For The 3DS Posted: 26 Nov 2011 08:19 PM PST  It’s not hard to love Mario. He’s had his ups and downs – what, for example, was the deal with Paper Mario? And Super Mario Strikers was pretty hard to love, at least for this non-sports fan – but darn it if the little guy doesn’t keep coming back for more and keeps you, at the very least, entertained. Super Mario 3D Land is the latest in the Mario saga. The story is fairly typical – something was stolen (a lot of leaves) and Bowser took Princess Peach. Your mission is to find the leaves (which are special and give you the Tanooki suit) and then find Peach. What you go through to find her, however, is where all of the fun comes in. The game is a 2D platformer turned 3D. You move swiftly through a nicely rendered 3D land and hop, stomp, and jump on enemies and into question blocks. Initially gameplay is a bit stiff and weird but once you realize you’re actually following a nicely and cleverly set path through this 3D world you can loosen up and explore a bit. Mario has existed in 3D before, most strikingly in in Super Mario 64. This game has very little to do with that title and is instead a fully-formed platformer in 3D. It is more on par with Super Mario Galaxy in terms of gameplay and mechanics and it’s clear the 3D Land is a Galaxy title reduced in scope and, obviously, space flight. Now for the million-dollar question: how is the 3D on the 3DS? The problem with the 3DS is you often lose the 3D sweet spot while heavily into gameplay. This problem is quite pronounced in action titles like Starfox and less prevalent in SM3DL. However, it was a bit frustrating and I often resorted to turning 3D off while playing. Does this mean the 3D doesn’t work? No, but it wasn’t quite to my taste. The game itself offers excellent playability and the “help” system, namely a super leaf that essentially allows you to breeze through the level unharmed by enemies and with a flying Tanooki suit, makes it great for novices. The help system kicks in after two deaths – it gives you a power-up – and then when you die five times it gives you the special leaf. Basically it helps reduce the frustration for casual gamers. This is a Mario game. Mario is great. Is it worth buying a 3DS over? Probably not unless you’re also a Zelda fan as Ocarina of Time is superb on this device. However with the launch of the equally superb Mario Kart 7, Nintendo does offer some compelling reasons to pick up their console – and this game – for the holidays. Click to view slideshow. |

| How to Make Your Startup Go Viral The Pinterest Way Posted: 26 Nov 2011 01:48 PM PST  On Thanksgiving, Pinterest's co-founder Ben Silbermann sent an email to his entire user base saying thanks. It was fitting, as Pinterest was born two years ago on Thanksgiving day 2009. Ben had been working on a website with a few friends, and his girlfriend came up with the name while they were watching TV. Pinterest officially launched to the world 4 months later. Some startups go crazy with hype and users right after launch. And some don't. I don't know the founders, but I thought I'd take apart Pinterest's story to discuss growth and virality in consumer web startups. Pinterest was not an overnight success. On the contrary, its growth was surprisingly modest after Turkey Day 2009. Take a look at Pinterest's one-year traffic on Compete from Oct 2010 to Oct 2011, which is the picture in this post, and shows Pinterest rising from 40,000 to 3.2 million monthly unique visitors. I took both ends of this chart and estimated monthly compounded growth over Pinterest's lifetime, then interpolated the curve using constant growth and put the results in this Google Spreadsheet. Backing out of Compete's numbers, we see Pinterest grew about 50% month over month from a base of zero since its inception (on average, smoothing the curve). Today growth is catching fire, as evidenced by the near doubling of traffic last month, and Pinterest's page views growing 20X since June, according to comScore. Note these numbers are approximations and also do not count the significant traffic the service sees from mobile (Pinterest's app currently takes the #6 social spot in the iTunes store). Also my guess is that a lot of its unique visitors arrive out of network (from Facebook / Twitter), and many of these uniques leave Pinterest without registering (more on this below) so it's tough to know their exact user numbers. But let's play pretend and use the data we have to do some projections on where Pinterest could be a year from today. Its recent VCs certainly did this, and decided to give the startup a $200M+ valuation. Ron Conway said recently that Pinterest is growing like Facebook did in 2006. Facebook actually grew from 14 million uniques to 26 million uniques from May 2006 to May 2007, then a year and half later they had rocketed to 140 million uniques, and were growing at about 20 million uniques per month. So monthly growth early on for Facebook was around 10-15%. Can Pinterest really sustain its wild 45% monthly growth? No, unless it's destined to be the fastest growing startup in history. However, we can be pretty sure Pinterest has hit a tipping point… their page view numbers are simply insane. If they were to grow 20% month/month over the next year, Pinterest would be at 30 million uniques a year from today. And with 25% month/month growth, they'd be at 50 million. These are pure guesses, but Ron's statements and last month's growth make this look possible, so let's examine virality and Pinterest's underlying fundamentals. Virality – Does My Startup Really Need It? Viral sharing is typically emphasized in products or services where the cost to acquire a customer needs to be low, and you can't afford to spend money on paid channels, like Mint.com did, or like a Living Social / Groupon. Having a free method, ideally a user-driven method, is critical to consumer web startups. But there's a lot of confusion around virality. The reality is that you can build a sustainable business without "going viral" and this point is not understood well among techies or investors. The connotation "going viral" typically means having a viral growth coefficient of greater than 1. For every user that comes on your platform, he or she refers 1 additional user. This ensures a service will "hockey stick". But what if every user only refers, say 0.2 new users? Contrary to popular belief, this can also lead to a sustainable business. However, the lack of pure virality implies that you absolutely must retain existing users to grow. This is why daily active users and monthly active users are such important metrics, and are tracked maniacally by CEOs and investors. Churn is your ultimate enemy. Sure, it will take longer to grow if each user brings in fewer new people, but as long as most users don't leave, you're all good. Viral cycle times also factor in – the shorter the "referrer" period, the faster the virality takes hold – for example, if a user invites 1 new user every month, that's better than if she invites 1 per year. Social games like Zynga historically have extremely short viral cycles; however they must, because churn is extremely high (user lifetime is often measured in hours or days, because users get bored with games quickly and move on). Obviously, the more viral a service, the more sustainable it is, but it's really in the details. And overnight success is not a guarantee for sustainability. Many startups are pushing way too prematurely on press before they've demonstrated real sustainability. I see this all the time and Eric Ries covered this in his discussion on the danger of vanity metrics. The truth is that startups often draft off of artificial success that originates simply from hype within the tech echo-chamber. Some sites go from 0 to 100K+ visitors in weeks and people high five one other, then look around and say "what's next, how do we keep these users happy?" Pinterest's Virality and Sharing Examined Pinterest's story is much different – they didn't have the same early "hype spikes" as many other startups do, standing at only 40K uniques 8 months after launch! It took Pinterest quite a while for a network-effect to take hold. Clearly every startup should hope for early virality. But if it doesn't exist initially, you must work to perfect a soft onboarding of virality that's based on high engagement, and create a product that people love and will come back to, while layering viral techniques on top of that. Today, Pinterest is clearly insanely addictive among its user base, and they are sharing. But one reason I see Pinterest as a valuable a case study is precisely because they didn't experience the early adopter "hype" spike 18 months ago. Like many tech startups, I am sure some content was seeded within the tech community by the founders. But their "normal" user was a housewife in the Midwest, not a techie reading TechCrunch or Hacker News. And I'm sure Pinterest made a bunch of product tweaks early on to iterate around sharing and engagement, as virality took hold. Let's compare Pinterest to Instagram for a minute, since both base off of photo content as their primary unit. Instagram has actually done nearly all its user acquisition virally out of network (sharing to Facebook and Twitter) and via word of mouth, with limited sharing in the network. This is remarkable when you think about it. By that I mean that there's no real sharing inside the network other than liked photos surfacing due to popularity, and manual discovery via hashtags. There is no "regram" if you will. You also can't follow people or like a photo from Instagram without an iPhone (even if it's tweeted or posted to the web!) unless you're a power user on an API mashup (see Inkstagram). All this reveals just how impressive Instagram's growth has been, as they went from about 1 million to 10 million users over the past year. Being realistic, Pinterest could have much higher growth than Instagram based on the fact that it's unconstrained as a platform – it works from web, mobile web, in-app, and has easier baked-in virality around sharing. "Pinning" has this built in because many initial pins start as "repins" of other people's content. In this way, existing content will often be the seed for a new user's stream. The pin unit is genius. Users can also visit the Pinterest site and participate (i.e. browse endlessly) before signing up. This allows full consumptive access before registering and is a secret weapon if done right. Fred Wilson discussed this recently in his post about the logged out user, giving an example of his mom checking his tweet stream without logging into Twitter – she gets value out of the service while ironically bringing down Twitter's monthly active user metric. Similar value can be granted to consumptive users who visit the site but don't initially register. Then when a user is ready to pin content, they create an account and go wild – Pinterest leverages web content from Tumblr like no site that has ever existed, thus riding on top of its network-effect while not requiring user generated content like many services. They've also perfected in-network virality (pin, repin, like) in addition to out of network sharing (Facebook, Twitter) to grow virally. For these reasons Pinterest could conceivably grow as fast as any consumer service we have seen in recent memory. It's fun to speculate on all this when you factor in Ron Conway's statements comparing growth to Facebook's early heydays. And perhaps most notably, though it will surely take a while, Pinterest is already threatening to monetize, as those Midwest housewives are literally using it for shopping discovery, which Pinterest can profit off of by taking attribution for purchases that originate off its platform. I know several friends who've purchased stuff spontaneously via random discovery on the site. I expect Pinterest to be thriving a year from now (my guess is 30 million users next Thanksgiving) and also spawn hundreds of copycat startups in other verticals ("Pinterest for that"). Sadly, many of these will arrive on TechCrunch and spike in hype, then fail to nail any true virality before they are slowly forgotten… After all, this is the cycle of consumer startups. _________________________ Contributor Steve Cheney is currently Head of Business Development at GroupMe, and formerly an entrepreneur, engineer & programmer specializing in web and mobile technologies. You can follow him on Twitter @stevecheney |

| (Founder Stories) Bump’s David Lieb: “We Want To Build That New UI Layer For The Real World” Posted: 26 Nov 2011 12:56 PM PST  Seeking a way to reduce friction while exchanging contact information, David Lieb and his two co-founders launched Bump – a service that allows users to swap everything from calendar events to music samples by simply tapping their smartphones together. In part II of his Founder Stories interview with host Chris Dixon, Lieb tells Dixon the big picture plan. “There is a lot of time spent figuring out how I interface with this [smartphone] to go access the virtual world, but nobody has really spent a lot of time thinking … how do I want to interact with other people and things in the real world, and that is the problem that we want to solve, we want to build that new UI layer for the real world.” Prior to making this point, Lieb and Dixon discuss Bump’s decision to allow companies like PayPal (and hundreds of others) to embed its code into their apps. While this would seem to be a big opportunity for Bump, Lieb notes, “as it turns out, our growth has been so rapid that our app just dwarfs any of these other apps that use our API.” Regarding PayPal specifically, Lieb says, “last time I checked I think there were like 10-million installs, maybe, so we have 6-times that.” Helping Bump hit that 60-million mark were Sequoia Capital who led a Series A round and Andreessen Horowitz who led a $16 million Series B round. Having steered the company though such growth, Lieb says managing emotions is still a bit tricky. “There are definitely days where I am like wow, we are just killing it, this is awesome and then 18 hours later, someone says something or we get some new information and we are like, ah man, we are totally screwed, and usually the answer is somewhere in the middle.” Make sure to watch the entire video of additional insights, along with episode I here. Past episodes of Founder Stories, featuring Drew Houston, Eric Ries, Kevin O’Connor, Christopher Poole and other leaders are here. Episode III of Lieb’s interview is coming up. |

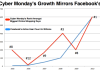

| Cyber Monday Piggybacks On Social Media To Become Top Online Shopping Day Posted: 26 Nov 2011 12:55 PM PST  Editor's note: Scott Silverman is the co-founder and VP of Marketing for Ifeelgoods, Inc., a digital goods incentive platform. Prior to Ifeelgoods, Silverman spent more than 10 years as Executive Director of Shop.org and is one of the creators of Cyber Monday. You can follow him @scottsilverman. When the term Cyber Monday was coined in 2005, the Monday after Thanksgiving was the 12th biggest online shopping day of the year. That year, Facebook had 5.5 million users and Twitter didn't exist. In 2010, Cyber Monday was the #1 biggest online shopping day of the year, with sales topping $1 billion. I believe the growth of social media and the importance of Cyber Monday are correlated because peer -to-peer sharing of deals and owned marketing channels like Facebook Pages and Twitter accounts are bringing promotions directly to where users spend their time online. The red line is where Cyber Monday ranked among the top online shopping days (from comScore press releases) for that year. Aside from 2008, which is an outlier due the recession, there is a trend in Cyber Monday popularity growing along with Facebook users. As background, Cyber Monday was coined in 2005 by e-commerce industry group Shop.org while I was its executive director. The trend was identified through data from online retailers who in in previous years had seen spikes in sales the Monday after Thanksgiving. It seems that people go online to continue their post-Black Friday shopping for items they didn't buy, perhaps because they wanted to research them more thoroughly or buy them out of the sight of the intended recipient. There is an argument about the impact of social media on retail sales. Some are skeptical, saying social isn't as effective as email marketing or paid search advertising for customer acquisition. Others think the shift to social advertisements and viral marketing is just starting to take off. The debate will surely continue as researchers struggle to identify the perfect science for measuring its effect. Ironically, data about the impact of TV and radio ads remains just as elusive, yet broadcast advertising continues to command a disproportionate amount of spending. But retailers are successfully building their presences on social networks. The 25 U.S. retailers with the most fans on Facebook had a combined 259 million fans in October. During the holiday season, these fans will find deals from retailers who've invested in social. Retailers hesitant about social will be less likely to attain sales from these users as their competitors profit. According to Shop.org, 29 percent of consumers will check out a retailer's Facebook page as part of their online holiday shopping this year. Of course, these are just the people who say they'll seek out this information and it doesn't take into account the number of people that will see sales and promotions from retailers in their news feed. Data aside, there is no question that social media is having a profound impact on the way we shop. Today, we depend on our social networks to tip us off to the best deals and sales. Only two or three years ago this was not the case. |

| Thanksgiving + Black Friday Mobile Traffic Up 60% From 2010 Posted: 26 Nov 2011 12:08 PM PST  Mobile is growing as a medium for ecommerce, with users sourcing deals from their phones and tablets before visiting physical stores according to a new study by Usablenet, The company which powers mobile sites for 100 top U.S. retailers including JCPenney, Aeropostale, and REI tracked 18 million page views and 1 million mobile users over Thanksgiving and Black Friday. It saw mobile traffic to its clients was up 60% from the same period last year, with Thanksgiving sending more traffic than the following day. Usablenet also found that iOS devices accounted for 42% of the traffic, trumping Android, and trouncing the tiny traffic from Windows and Nokia devices. Earlier today, Leena reported that Black Friday online retail spending was up 24.3% this year, and that mobile increased it share of total traffic and sales. In addition to driving sales directly, though, mobile is facilitating offline sales and product pick-ups. Usablenet tells me, “Thanksgiving activity focused on finding and purchasing deals such as deals of the day, driven from email marketing along with high usage of the purchase online and pick up in-store option.” On Black Friday, mobile usage centered around finding store locations, browsing reviews, and accessing previously saved wish lists while people walked aisles at their local merchants. These insights can help retailers plan for next year. They should look to send out email marketing and deal notices early on Thanksgiving, as that’s when people make decisions of where to shop. This could work better than distributing promotions right at the start of Black Friday when customers may have already set a shopping agenda. Traffic by mobile operating system also mirrored sales, with iOS taking the biggest cut, but less than last year. Android is creeping up, accounting for 34% of mobile traffic up from 28% in 2010. BlackBerry still represents a respectable 15% of mobile traffic, while Windows and Nokia each made up less than 3%. If this trend continues, by next year it may be just as important for big retailers to offer Android apps as iOS ones. |

| Sing Now The Praises Of Klout’s Klumsy Kludges Posted: 26 Nov 2011 11:01 AM PST  Over the last month, Charles Stross memorably called the online influence measurer Klout “the internet equivalent of herpes,” Rohn Miller of Social Media Today exhorted people to “Delete your Klout profile now,” John Scalzi lambasted it as “sad, and possibly evil,” the New York Times wrote about parents’ outrage when they discovered Klout was autogenerating accounts for minors, Flout caustically mocked them with the insincerest form of flattery, and perhaps most damning of all–it’s one thing to be controversial, another and far worse to be irrelevant–our own Alexia Tsotsis convincingly argued that “Nobody Gives A Damn About Your Klout Score.” Why all the hate? Stross cites privacy violations, but it can’t be that alone which inspires such vitriol. As Mathew Ingram points out, “it's hard to see why Klout should be criticized for collecting information about people based on their public web activity.” Scalzi gets more to the heart of things: “Klout exists to turn the entire Internet into a high school cafeteria, in which everyone is defined by the table at which they sit.” Oh noes! It’s an online popularity contest! Stone them! Let me offer a different take: Klout, as flawed and clumsy as it is–and I’ll admit that in many ways it’s a terrible service–is an admirable pioneer, a first innovative step in an important direction. Everyone keeps talking about the reputation economy, but there’s never been any such thing. Reputation, influence, and popularity have always been at least as big a deal as money–we’re social animals, it’s hardwired–but you can’t have an economy until you’ve quantified its measure. Klout is the first example of that quantification that’s gotten any kind of mass traction. That’s important. Let’s talk about Whuffie. Never heard of it? Crack open a copy of Down and Out in the Magic Kingdom, a novel by Canadian author Cory Doctorow that depicts a post-scarcity society where money has been replaced by “Whuffie”, a measure of reputation. (Doctorow doesn’t shy away from the dark side of his speculative future, either. At one point his protagonist falls into depression, loses all his Whuffie, is shunned by all … and the reputation-economy utopia suddenly looks a lot more like a Darwinian high-school popularity contest.) Is Whuffie the future? Well, no, money isn’t exactly about to go away. But I do believe there’s an aspect of prophecy to Doctorow’s vision: once a real reputation economy exists, it will become increasingly important, as it thrives and grows in parallel with–and interwoven with–the monetary economy. Will Klout be the measure of that forthcoming reputation economy? Well, er, no again. Klout only tries to measure “influence”, rather than the complex nuances of “reputation”, and it doesn’t even really succeed at that. The results of its allegedly sophisticated signal-crunching tend to range from the bewildering to the bizarre, making you wonder if, in fact, its algorithms were scribbled on the back of a napkin one drunken night and thrust hastily into production. But I still have some considerable sympathy for Klout’s CEO Joe Fernandez, and his response to the recent onslaught. The hate that Klout elicits is wildly disproportionate to what it deserves. In the long run, the reputation economy will be incredibly important, and the company that codifies and defines that economy will be… …probably a company that doesn’t exist yet. I expect Klout will ultimately become to the real reputation economy what tribe.net was to social media; a trailblazer that became a footnote. But that’s still no small thing, and certainly no cause to hate. Let’s all lighten up and give them, well, a little more credit. They’ve earned it. |

| You are subscribed to email updates from TechCrunch To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment